If you’re looking to attract more customers, you need to understand how their emotions impact their buying behavior. Emotions are the biggest drivers of purchase, after all.

And that’s where the theory of loss aversion comes in.

In this article, we’ll be discussing:

Basic Principles of Loss Aversion

The Power of Loss Aversion Marketing

How to Implement Loss Aversion in Advertising

What Can We Learn from These Examples?

Loss aversion is the feeling of discomfort or reluctance when making a decision that could lead to a loss. When it comes to marketing, this can be very beneficial.

We’re creatures of habit, and we tend to do things over and over again because that’s how we’ve been taught to do things.

This isn’t always a bad thing; often, it can be helpful to have a few familiar ways of doing something.

However, when it comes time to make a change, we often find ourselves at loggerheads with our old habits.

That’s where loss aversion marketing strategies come in.

If you want something but are indecisive about making a purchase, will you be more willing to decide if you know that the product you want is on offer for a limited time frame?

Does the thought of losing money instill a sense of fear?

I’m pretty sure it's a yes.

Or, perhaps the original price was a little out of your budget but, the item is now going for a lower price but for a limited time frame?

Herein lies an opportunity for the customer to save money!

Would this make you more willing to commit now and buy?

Yes, it would because you have the fear of missing out.

It can make you more sensitive to potential customer losses and help you find the right products and services to sell, or at the very least, the right marketing angle.

What is Loss Aversion?

Loss aversion is the psychological term for the reluctance to give up benefits due to potential risks. It's a term used often in behavioral economics and helps us better understand consumer behavior.

It’s important to understand how loss aversion works so that you can use it effectively in your marketing strategy.

Loss aversion is the difference between the potential benefits of a specific behavior and the risks associated with that behavior.

When you choose to do something, you may be willing to risk some of those benefits to achieve your intended outcome.

Conversely, when you choose not to do something, you are less likely to risk any of those benefits.

This is why it’s important to understand loss aversion so that you can use it effectively in your marketing campaigns.

The Theory Behind Loss Aversion

Loss aversion marketing didn't just come out of nowhere; in fact the theory was formulated by Nobel prize-winning psychologists Daniel Kahneman and Amos Tversky in 1979.

Kahneman and Tversky created a mathematical equation that describes the way people make decisions.

Loss aversion theory is one of the aspects that has been used to describe how people make decisions.

In their findings, they discovered that people experience unpleasant emotions when they think they might lose out, which means they would rather avoid losses than make gains.

People are loss averse when it comes to gains and liabilities.

They called this tendency the “endowment effect,” which was later defined as the difference between how people value something they own and how they value something they don’t own.

This means that when you give someone a gift, the person will probably value it more than if he or she had bought it for themselves.

Endowed Progress Effect And Status Quo Bias

is an extension of the endowment effect. It is a tendency for people to value a good or service more once they have invested time or money in it.

Kahneman and Tversky’s findings were revolutionary because they showed that people are not always rational in their decision-making. The findings also showed that people are loss reluctant, which means that they tend to avoid potential losses more than they will go after potential gains.

Interestingly, they also uncovered the status quo bias, which is the tendency of people to choose the status quo, even though it may be less favorable than an alternative. This means that people are more likely to stick with what they have instead of taking a risk and switching to something else.

This shows that people are more willing to take risks to avoid a loss than they are to gain something.

The Basic Principles of Loss Aversion Marketing

There are three basic principles of loss aversion marketing that can be used to help marketers and advertisers persuade consumers to buy their products.

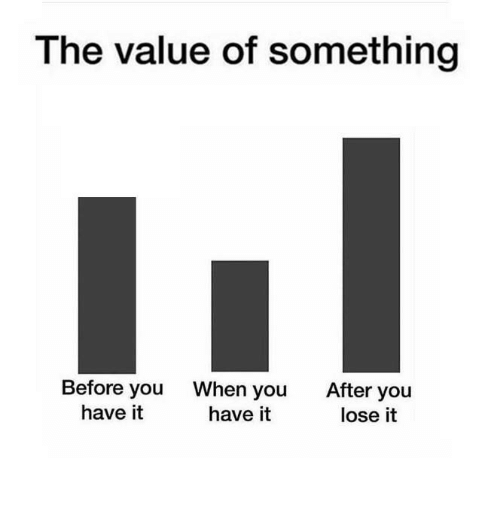

1. Loss > Value

The first principle is that people value potential losses more than they value potential gains. The value of the loss feels greater than the value of the gain even when they actually the same.

This means people will work harder to avoid a loss than they will work to achieve a gain.

2. Pain > Pleasure

The second principle states that the pain of losing something is greater than the pleasure one gets from gaining something of equal value.

It means you’re more upset about losing an object than you are happy about gaining it in the first place.

3. Losses > Gains

Finally, the third principle states that losses loom larger than gains.

It means people feel worse when they risk losing something they have than they feel good about gaining something they don’t have.

The economists suggest that this tendency to avoid risk is a result of people's desire to keep things as they are.

“People are generally averse to change,” Kahneman Tversky noticed. “They prefer a known state to an unknown alternative and tend to avoid options that involve uncertainty, even when the options are equivalent in expected value or have the positive expected value.”

The Power of Loss Aversion in Marketing

Loss aversion marketing is also used by marketers and advertisers to persuade consumers to buy their products based on the fear that they will lose something if they don’t.

The way loss aversion marketing strategies work in general is by having two options:

1) The “loss” option which means losing something such as money or time

2) The “no loss” option which is a way to avoid losing something

Marketers try to make the “loss” option undesirable and the “no loss” option desirable. Consumers have a natural inclination or bias towards avoiding losses – for this reason, loss aversion marketing strategies often work well.

One study showed that students were more likely to complete an exercise if they were told that there was a chance they would lose 25 cents as opposed to being told there was a chance they would win 25 cents!

Example 1. Avoiding Negative Outcomes

In general, loss aversion marketing works because people want to avoid negative outcomes even if it means getting a lesser outcome than what they originally wanted.

For instance, let’s say you are considering buying a new set of tires for your car but you aren’t sure which ones to buy.

You go online and find a website that is offering free installation if you buy certain tires, but you don’t want to pay for shipping so you consider buying from a local retailer instead.

The local retailer offers the same kind of deal – free installation if you buy the tires they are selling locally. However, this particular store doesn’t have your tires in stock so they will order them for you at no extra cost to yourself (in other words, it’s “free shipping”).

The loss aversion marketing strategy here is that the shop has given you “no loss” option by allowing you to get your new set of tires without having to pay any extra even if it means waiting a little bit longer to get them — this is an incentive for customers who want their tires as soon as possible.

Example 2. Other People Are Losing Money but Not You

On the other hand, the store offering free installation if you buy from them directly means that they are essentially “losing” money by not charging you any extra – this is a way of making people feel more inclined to buy from them instead of buying from someone else.

In another example, let’s say you have been thinking about hiring a painter to paint your house but haven’t called anyone yet.

You come across an ad in the newspaper that promises painted houses at the lowest prices guaranteed or your money back!

The loss aversion marketing strategy here is that giving consumers their money back is a way of avoiding loss for them i.e. they will not have to pay anything extra if the job is not satisfactory — this makes you more inclined to hire them instead of someone else even if you were going to do so anyway.

On the other hand, promising painted houses at the lowest prices is a “loss” for the painter as they are giving up profits i.e. charging less means that they will make less money – this makes consumers feel like it’s worth hiring because you won’t be paying too much considering what you get in return (a painted house).

Best Ways to Utilize Loss Aversion

1. Discounts and Coupons

The most common way this is used is in sales promotions such as coupons, rebates, and offering discounts.

For instance, when you see a promotion offering something like “$5 off if you spend $25 or more”, the fear that comes in when considering not using this promotion is that you will be losing the $5 in savings, even if it meant spending $25!

2. Reduce Product Returns

Loss aversion marketing has also been used by marketers in an attempt to reduce product returns.

For instance, some retailers such as Best Buy and Target offer a reduced price on an exchange policy. If you buy a laptop for $500 and decide that you want to return it within the first 15 – 30 days, they will give you back $100 – $150 of what you originally paid (depending on how far into the policy period you are).

This is intended to be an incentive for consumers who were thinking about returning their products anyways to think twice about returning the item since they will lose $350 to $400!

3. Introducing New Products

Marketers also use loss aversion marketing to their advantage when they advertise new products. The fear of missing out on something new and exciting can be enough to persuade customers to buy an unproven product over their usual favorite brand.

How to Implement Loss Aversion in Advertising

In general, loss aversion strategies are used by marketers to help them achieve their marketing efforts.

The key is to make sure that the customer or client feels like they are missing out on something.

This is used by marketers everywhere and can take many forms but it all boils down to one main concept, creating a sense of urgency.

When you do this, you inspire fear.

You need to inspire fear when putting your marketing plan into action.

You want to create a sense of urgency so that your customers or clients see that there’s a threat in not doing what you’re asking them to do.

Here are some common methods used in implementing this theory in marketing strategies.

Customer Focused Content

Successful marketers are well aware of the benefits of social proof because it's a crucial element of executing a loss aversion strategy.

As a reference point, social proof helps customers to believe in your brand because it shows them that other people like them have enjoyed the product or service.

This is where marketing copy becomes very important.

Show your customers how other people in their same “tribe” are enjoying something you offered them.

Furthermore, create valuable content that can help improve a person's perception of your brand — this can include reviews, tutorials, or blog posts that focus on the positive aspects of being a customer for your company.

Free Samples and Sales

The best way to use loss aversion is through free samples and coupons.

When you have a sale, make sure that the coupon has an ending date because people are more likely to purchase something if they are given a deadline.

This can be a great way for you to get on the customer's radar and also to increase your sales.

Create FOMO

What this does is create FOMO (fear of missing out), your customers have read wonderful things and now want to experience the product for themselves.

This is the main driver for the Black Friday-Cyber Monday phenomenon.

When companies are offering huge discounts on items, you as a customer will definitely make a purchase — any purchase — just so you don’t lose out on possible discounts. Even if it means buying something you don’t really need at the moment.

When you leverage loss aversion along with this, you're creating a recipe for success!

Free Trials or Limited-time Bonuses

You can create a sense of urgency by offering your customers or clients something for free, like a bonus product or service, or, a free trial.

After all. Who doesn't love a freebie!

But, for a limited time frame. Of course.

You can also offer them an incentive, like a discount on their next purchase if they take action right now.

Countdown Timers

When it comes down to human decision-making, early access creates an ownership people hope to hold onto. You’re whetting the customer's appetite.

Web pages incorporating countdown timers also work incredibly well because provides a visual of the fact that time is running out.

This offer is going to end so you need to do something now in acquiring gains.

These also work well with teaser campaigns.

For instance "We're offering your product x, but it will only be available for the next 24 hours."

In a nutshell, your customers need to be made aware that what you've given them is something special.

It's a limited-time offer that won't be available much longer thus, you're triggering their buying instinct because if they don't do it now, they will lose out.

Consider its potential pros and cons and use it strategically in your email marketing, ad marketing, and sales efforts to increase conversions and to improve brand engagement.

Examples of Loss Aversion in Advertising

Now that you understand the concept of loss aversion, let's take a look at some real-life examples of this theory being applied in marketing.

-

Bitcoin Banner Ad

If you invested $100 in BTC in 2010, you would have been $2 billion richer now... or something along those lines.

This is one of the best loss aversion tactics we've seen, and it's one of the drivers that pushed people to scramble to get into the cryptocurrency scene. If you didn't invest in Bitcoin, it may seem like you're leaving money on the table, and that's what this ad is promising.

And the best part is that it creates a sense of urgency that every second that passes by, you are already losing money!

-

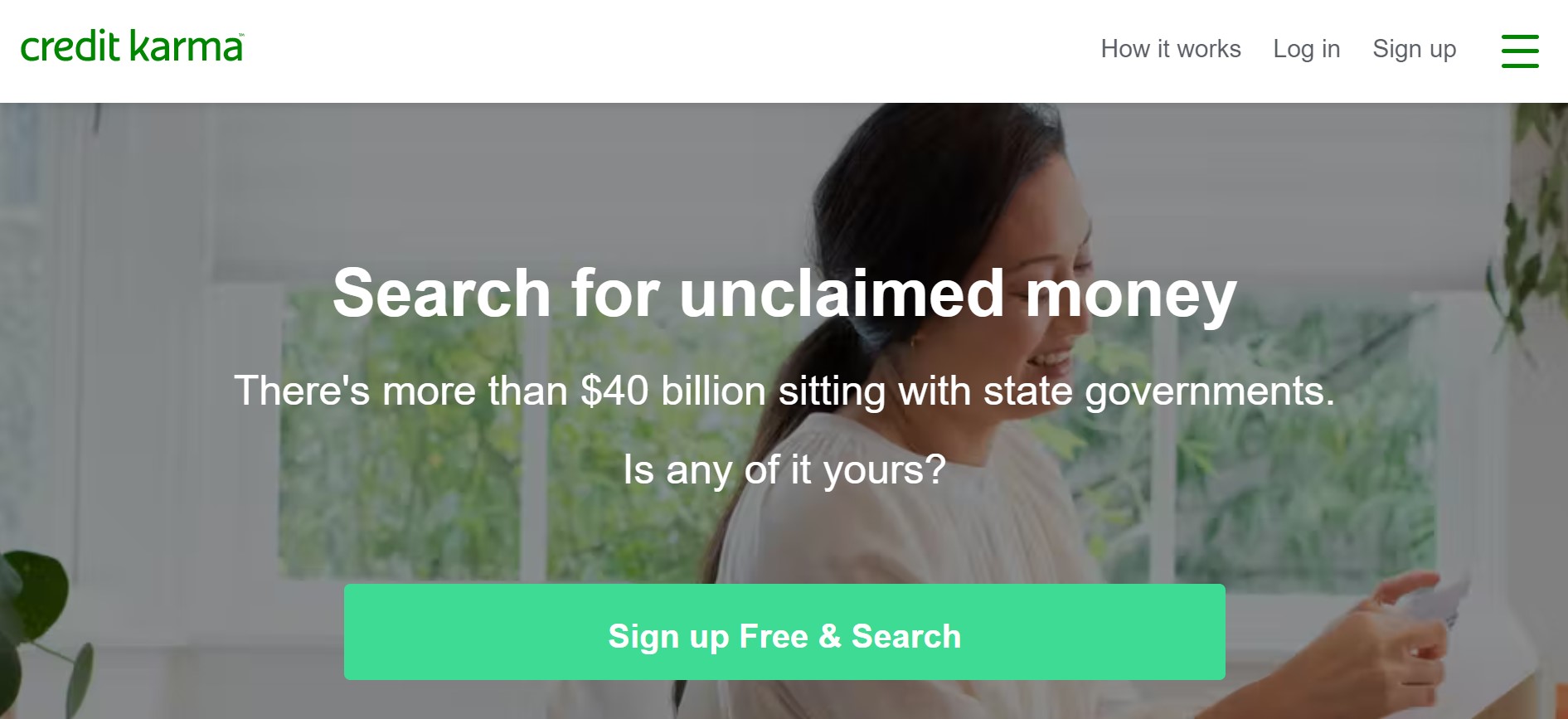

Unclaimed Money

Those who are in the refinance industry use this marketing tactic efficiently.

"There are over $40 billion in unclaimed federal funds. Why not claim it?"

This ad is saying that if you don't claim these funds, you're losing money to the government. However, they also apply another loss aversion tactic by saying, "if you do claim these funds, your refund will be guaranteed".

Most of the time, people who need money are also on the lookout for free money, so ads like these are pretty attractive to them

We have seen this strategy being used for decades now and there's no sign of it slowing down anytime soon.

-

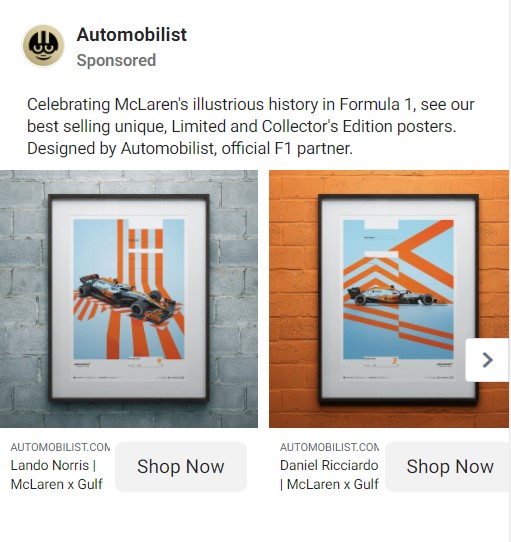

Limited Edition Items

Most people are loss averse when it comes to buying items that are labeled as limited edition.

For example, Coca-Cola is notorious for releasing limited edition bottles or glasses. So whenever that happens, people will scramble to buy them — even though they are the same product that they've been drinking for decades and that new "limited edition" products will also be offered next year!

Even social media advertisers use the loss aversion technique often, which is evident in the Facebook Carousel Ad shown below:

This only demonstrates how powerful loss aversion is as a marketing technique.

What Can We Learn from These Examples?

Remember that the best types of marketing are those that understand how humans are wired to react.

The idea behind loss aversion marketing strategies is that instead of trying to convince people by using positive arguments such as “great deals” or “quality products”, it is more effective to convince them by emphasizing the negative effects of not buying e.g. lose money if you don’t buy from us and we will give your money back!

This subtle change in marketing strategies can be very powerful because:

1. Marketing that works on a loss aversion basis makes people feel like they are losing something rather than gaining something (and humans hate losing much more than we like winning).

2. Loss aversion marketing also helps companies avoid coming across as too pushy or aggressive since instead of making consumers feel like they have to buy their product, the company only needs them to want not to lose out on anything.

The big lesson here is that you need to always look at how your product or service can be presented from the customer’s point of view to make it seem like they are getting a fair deal and not being ripped off.

If you present your offer in a way that makes people feel like they are missing out on anything, then you have a better chance of convincing them to buy from you!

Loss aversion is a cognitive bias that can help you persuade your audience to do things that they wouldn't normally do and will help you gain more customers.

You can use loss aversion in virtually any situation, whether it is on social media, product pages, or in person.

By using loss aversion effectively, you can make your audience want to buy your product or service, tell their friends about it or take some other action that will be beneficial for both of you.

In Conclusion

Loss aversion marketing has been around for a long time and has evolved alongside other types of advertising. Although many business owners see loss aversion as “negative” marketing because they have to use fear tactics in order to enhance their sales, most consumers are smart enough to know what they are being offered is fair.

The most important thing to remember about loss aversion is that it works best when the consumer feels like they haven’t lost any value with their purchase; as long as you give them a good deal, you will have a customer for life!

Speaking of which, did you know you are missing out on utilizing the best social media and native advertising management platform available today? Get a 14-day free trial of Brax today and see how easy it is to manage all your business or agency's ads!